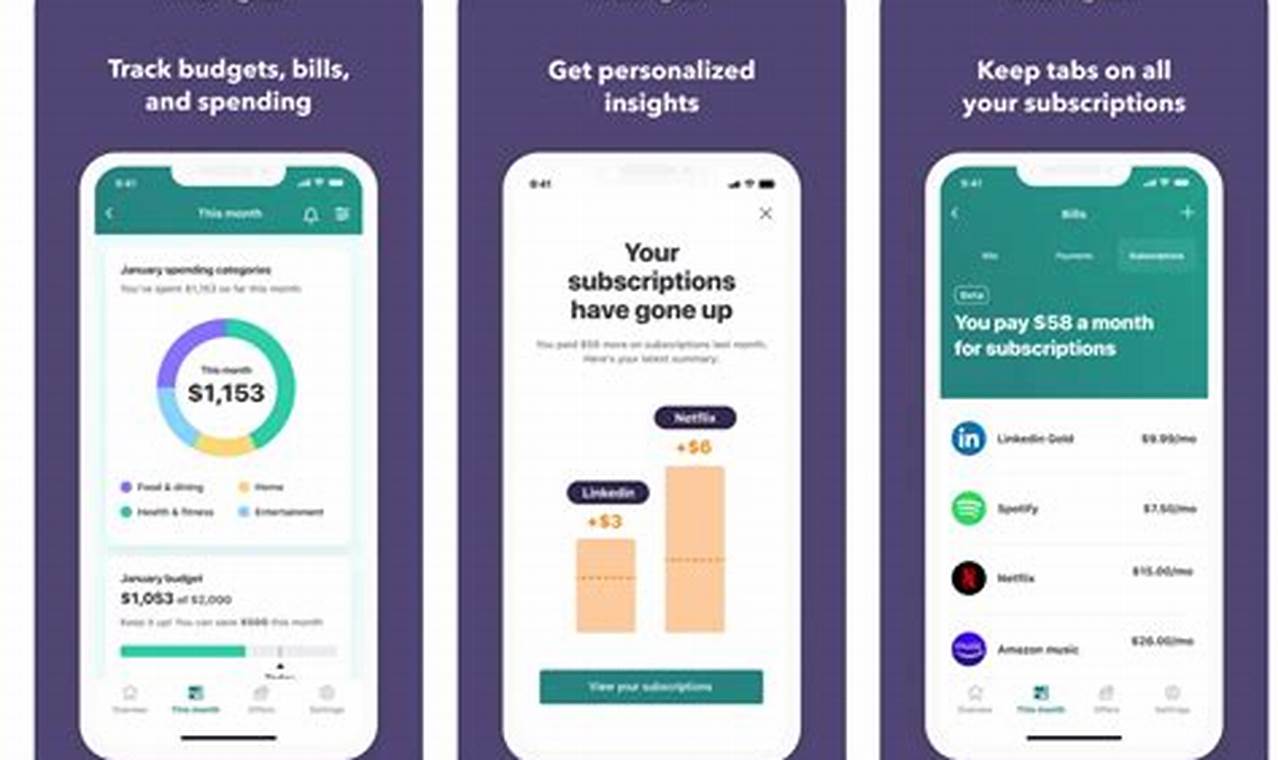

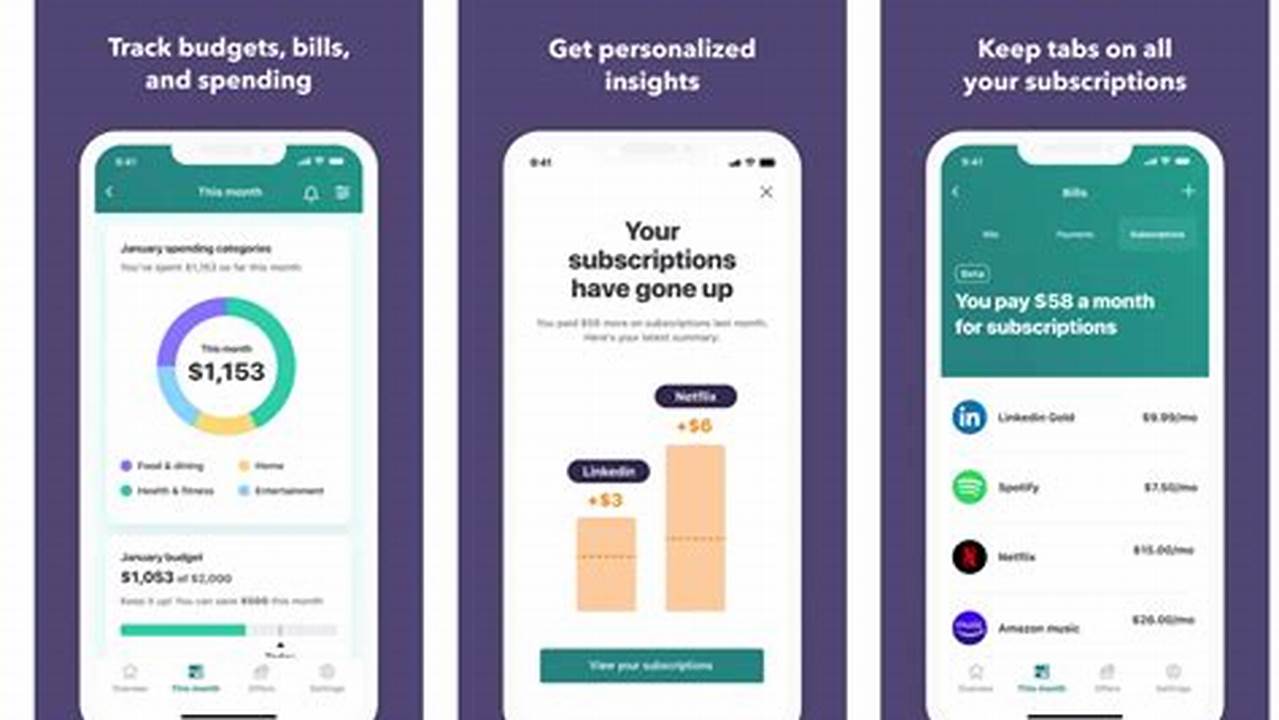

Top-rated mobile applications designed for personal financial management offer a range of functionalities, from budgeting and expense tracking to investment monitoring and debt management. These tools often integrate with bank accounts and credit cards, providing users with a consolidated view of their financial health. For instance, some applications categorize spending automatically, allowing users to quickly identify areas of overspending. Others offer sophisticated features like portfolio analysis and retirement planning tools.

Effective financial management is crucial for achieving financial stability and long-term goals. Utilizing digital tools for this purpose can empower individuals to make informed decisions, avoid unnecessary debt, and maximize savings potential. Historically, managing personal finances involved manual record-keeping and complex calculations. The advent of mobile technology has revolutionized this process, making financial management more accessible and efficient than ever before.

The following sections will explore specific categories of personal finance applications, highlighting their key features, advantages, and potential drawbacks to assist users in selecting the optimal tool for their individual needs.

1. Budgeting Tools

Effective budgeting forms the cornerstone of sound financial management. Integrating dedicated budgeting tools within personal finance applications significantly enhances users’ ability to control spending, allocate resources effectively, and achieve financial goals. These tools provide a structured framework for managing income and expenses, fostering financial stability and informed decision-making.

-

Automated Expense Categorization

Many leading applications automatically categorize expenses based on transaction data. This feature provides users with a clear overview of spending patterns across different categories, such as groceries, entertainment, and transportation. Identifying spending trends empowers users to adjust budgets proactively and make informed decisions about resource allocation.

-

Customizable Budget Categories

Applications often allow users to create personalized budget categories tailored to their specific needs and financial goals. This flexibility ensures that budgeting aligns with individual lifestyles and priorities, facilitating more accurate tracking and analysis of spending habits. For example, users can create dedicated categories for home renovations, travel, or education expenses.

-

Real-Time Budget Tracking

Real-time budget tracking provides users with up-to-the-minute information on their spending against predefined budgets. This immediate feedback allows for timely adjustments and prevents overspending. Alerts and notifications can be configured to signal when spending approaches or exceeds budgetary limits, enabling proactive financial management.

-

Goal-Oriented Budgeting

Some applications facilitate goal-oriented budgeting, allowing users to set specific financial goals, such as saving for a down payment or paying off debt. The application then tracks progress toward these goals and provides insights into the adjustments needed to achieve them. This feature promotes financial discipline and encourages long-term financial planning.

The integration of these budgeting tools within personal finance applications provides users with a powerful suite of resources to manage their finances effectively. By leveraging these features, individuals can gain a comprehensive understanding of their spending habits, make informed financial decisions, and achieve their financial objectives.

2. Expense Tracking

Expense tracking constitutes a critical component of effective personal financial management, and its integration within leading finance applications significantly contributes to their overall utility. Detailed expense records provide crucial insights into spending patterns, enabling informed budgetary adjustments and facilitating the identification of areas for potential savings. Without comprehensive expense tracking, individuals may struggle to understand where their money is being spent, hindering effective financial planning and potentially leading to overspending and debt accumulation. For instance, regularly tracking recurring expenses, such as subscriptions and utility bills, allows users to identify potential cost savings through service comparisons or contract renegotiations. Similarly, tracking discretionary spending on entertainment and dining can reveal opportunities to reduce unnecessary expenditures and redirect funds towards savings or debt reduction.

The practical significance of expense tracking extends beyond simple awareness of spending habits. By correlating expenses with income and budgetary allocations, individuals can gain a comprehensive understanding of their financial health. This understanding empowers proactive financial decision-making, enabling users to adjust spending patterns, optimize savings strategies, and achieve financial goals. For example, tracking expenses related to a specific project, such as a home renovation, allows for accurate cost management and prevents budget overruns. Moreover, detailed expense records can prove invaluable for tax purposes, simplifying the process of identifying deductible expenses and ensuring accurate tax filings.

In summary, effective expense tracking, facilitated by well-designed personal finance applications, provides a fundamental building block for sound financial management. By offering detailed insights into spending patterns and empowering proactive financial decision-making, these tools enable individuals to take control of their finances, optimize resource allocation, and achieve long-term financial stability. Challenges such as maintaining consistent tracking habits and accurately categorizing expenses can be addressed through features like automated categorization and transaction importing, further enhancing the value and accessibility of these applications.

3. Investment Monitoring

Investment monitoring plays a crucial role within comprehensive personal finance management. Leading applications integrate portfolio tracking features, enabling users to monitor the performance of diverse asset classes, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). This consolidated view facilitates informed decision-making regarding asset allocation, risk management, and overall investment strategy. For example, real-time data updates on investment performance allow users to identify potential risks and opportunities, facilitating timely adjustments to portfolios. Furthermore, historical performance charts and analytical tools enable users to evaluate the long-term effectiveness of investment strategies and make data-driven decisions.

The cause-and-effect relationship between investment monitoring and achieving financial objectives is significant. Consistent monitoring allows for proactive adjustments to investment strategies based on market fluctuations and individual financial goals. Without regular monitoring, portfolios can become misaligned with target asset allocations, potentially exposing individuals to undue risk or limiting growth potential. For instance, failing to monitor the performance of a specific sector or asset class could lead to missed opportunities for diversification or rebalancing, potentially impacting long-term returns. Integrating investment monitoring tools within personal finance applications empowers users to stay informed and maintain control over their financial future.

Effective investment monitoring provides crucial data insights that drive informed financial decisions. By understanding the performance of individual investments and the overall portfolio, individuals can adjust their strategies, optimize asset allocation, and mitigate potential risks. Challenges associated with investment monitoring, such as understanding complex market data and managing diverse asset classes, are addressed by many leading applications through intuitive interfaces and educational resources. These resources empower users to navigate the complexities of investment management and make informed decisions aligned with their long-term financial goals. Ultimately, incorporating robust investment monitoring tools within personal finance applications enhances users’ ability to achieve financial security and build long-term wealth.

4. Debt Management Features

Effective debt management is crucial for achieving financial stability, and leading personal finance applications offer integrated features to address this critical aspect of financial well-being. These features range from simple debt trackers to sophisticated tools that analyze debt repayment strategies and provide personalized recommendations. The connection between debt management features and top-tier financial applications lies in their ability to empower users to take control of their debt, develop effective repayment plans, and ultimately achieve financial freedom. For example, an application might allow users to input various debts, including credit card balances, student loans, and mortgages, and then visualize the impact of different repayment scenarios. This visualization can motivate users to prioritize high-interest debts or explore strategies like debt consolidation to reduce overall interest payments.

The practical significance of incorporating debt management features within personal finance applications is substantial. By providing users with a centralized platform to track, analyze, and manage their debts, these applications promote financial awareness and responsible borrowing habits. Without such tools, individuals may struggle to understand the true extent of their debt burden, leading to potential financial distress. For instance, an application might calculate the total interest paid over the lifetime of a loan, highlighting the long-term cost of debt and encouraging users to explore strategies for accelerated repayment. Furthermore, some applications offer integration with credit counseling services or debt consolidation platforms, providing users with access to professional guidance and resources.

In summary, robust debt management features are an essential component of best-in-class personal finance applications. These features empower users to navigate the complexities of debt repayment, make informed financial decisions, and ultimately achieve long-term financial stability. While these tools can provide valuable support, addressing the root causes of debt, such as overspending or inadequate budgeting, remains crucial. Effective debt management, facilitated by well-designed applications, provides a pathway towards financial health and freedom, enabling individuals to take control of their finances and build a secure financial future.

5. Security and Privacy

Security and privacy are paramount concerns when selecting applications for managing personal finances. Given the sensitive nature of financial data, robust security measures are essential to protect users from potential fraud, identity theft, and data breaches. Applications handling financial information must prioritize user privacy and employ industry-standard security protocols.

-

Data Encryption

Strong encryption protocols, such as 256-bit AES encryption, are crucial for protecting data transmitted between the user’s device and the application’s servers. Encryption ensures that even if intercepted, the data remains unreadable without the decryption key. This safeguard is essential for preventing unauthorized access to sensitive financial information.

-

Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring users to verify their identity through multiple methods, such as a password, one-time code, or biometric verification. This makes it significantly more difficult for unauthorized individuals to gain access to accounts, even if they obtain the user’s password. MFA is a crucial feature for mitigating the risk of unauthorized account access.

-

Secure Data Storage

Applications should employ secure data storage practices, including secure servers and regular data backups. Data should be stored in encrypted format, and access controls should be implemented to restrict access to authorized personnel only. These measures protect user data from both external threats and internal vulnerabilities.

-

Privacy Policy Transparency

A clear and comprehensive privacy policy is essential for informing users about how their data is collected, used, and shared. Users should have access to this information and be able to make informed decisions about whether they are comfortable with the application’s data practices. Transparency builds trust and empowers users to protect their privacy.

In conclusion, prioritizing security and privacy is non-negotiable for applications handling personal financial data. Robust security measures, coupled with transparent data practices, are essential for building trust and ensuring user confidence. Applications lacking these critical features expose users to significant risks and should be avoided. Selecting applications that prioritize security and privacy empowers users to manage their finances with confidence and peace of mind.

6. User-Friendly Interface

A user-friendly interface is a critical factor in determining the effectiveness of personal finance applications. Intuitive navigation, clear data presentation, and accessible features contribute significantly to user engagement and the overall success of financial management efforts. Applications with cumbersome or confusing interfaces can deter users, hindering their ability to effectively track expenses, manage budgets, and achieve financial goals. A well-designed interface simplifies complex financial tasks, making financial management more accessible and less daunting.

-

Intuitive Navigation

Intuitive navigation ensures that users can easily access different sections of the application and find the information they need quickly. Clear menus, logical organization, and effective search functionality contribute to a seamless user experience. For example, an application might use a tabbed interface to separate budgeting, expense tracking, and investment monitoring, allowing users to switch between these functions effortlessly.

-

Clear Data Presentation

Effective data presentation is essential for providing users with actionable insights into their financial health. Charts, graphs, and other visual aids can simplify complex financial data, making it easier to understand spending patterns, track progress towards goals, and identify areas for improvement. Color-coding, clear labeling, and concise summaries further enhance data clarity. For instance, an application might use a pie chart to display spending across different budget categories, providing a quick visual overview of spending habits.

-

Accessible Features

Accessibility considerations are crucial for ensuring that all users can benefit from the application’s features. Features like adjustable font sizes, high contrast color schemes, and screen reader compatibility make the application usable for individuals with visual impairments or other disabilities. Prioritizing accessibility expands the application’s reach and promotes inclusivity.

-

Personalized Experience

Customization options allow users to tailor the application to their specific needs and preferences. Features like customizable dashboards, notification settings, and account linking options create a more personalized experience. This personalization increases user engagement and allows individuals to focus on the financial information most relevant to their situation. For example, users might choose to receive notifications about upcoming bill payments or customize their dashboard to display their investment portfolio performance.

In conclusion, a user-friendly interface is a defining characteristic of the best personal finance applications. By prioritizing intuitive navigation, clear data presentation, accessible features, and personalized experiences, these applications empower users to take control of their finances and achieve their financial goals. The ease of use fostered by a well-designed interface directly contributes to user engagement and the overall effectiveness of financial management efforts. A seamless and intuitive user experience is therefore not just a desirable feature but a critical component of successful personal finance management.

Frequently Asked Questions

This section addresses common inquiries regarding the selection and utilization of applications designed for personal financial management.

Question 1: How do these applications differ from traditional banking services?

While traditional banking services primarily focus on transactional functionalities like deposits and withdrawals, these applications provide tools for budgeting, investment tracking, and financial planning. They often integrate with various financial institutions, offering a consolidated view of one’s financial position.

Question 2: What security measures protect sensitive financial data within these applications?

Reputable applications employ robust security measures, including data encryption, multi-factor authentication, and secure data storage, to safeguard user information. Reviewing the application’s security and privacy policies is crucial before entrusting it with financial data.

Question 3: Are there costs associated with using personal finance applications?

Pricing models vary. Some applications offer free versions with limited features, while others operate on a subscription basis, providing access to premium functionalities. Comparing features and pricing tiers is recommended before selecting an application.

Question 4: How much time is typically required to effectively utilize these applications?

The time commitment varies depending on the complexity of one’s financial situation and the specific features utilized. Many applications offer automated functionalities, reducing the time required for manual data entry and analysis.

Question 5: Can these applications assist with long-term financial planning, such as retirement planning?

Many applications offer tools for long-term financial planning, including retirement calculators, investment projections, and goal-setting features. These resources can assist individuals in developing and monitoring progress towards long-term financial objectives.

Question 6: What criteria should be considered when choosing a personal finance application?

Key criteria include security measures, features offered, user interface, and pricing. Considering individual financial needs and preferences is essential for selecting the most suitable application.

Careful consideration of these frequently asked questions empowers informed decision-making regarding the selection and utilization of personal finance applications.

The subsequent section explores advanced features available in leading personal finance applications.

Tips for Optimizing Financial Management with Applications

Strategic utilization of personal finance applications maximizes their potential for improving financial well-being. The following tips provide practical guidance for leveraging these tools effectively.

Tip 1: Regularly Reconcile Accounts.

Regularly reconciling accounts within the application with bank and credit card statements ensures data accuracy and facilitates early detection of discrepancies or errors. This practice maintains data integrity and enables informed financial decision-making.

Tip 2: Utilize Budgeting Features Proactively.

Proactive budget management, facilitated by application features, promotes disciplined spending and facilitates progress toward financial goals. Regularly reviewing and adjusting budgets, based on income and expenses, optimizes resource allocation.

Tip 3: Explore Automated Features.

Leveraging automated features, such as automatic transaction categorization and recurring bill reminders, streamlines financial management processes and reduces manual effort. Automation enhances efficiency and minimizes the risk of oversight.

Tip 4: Set Realistic Financial Goals.

Setting realistic and achievable financial goals within the application provides direction and motivation for financial planning. Tracking progress toward these goals fosters accountability and promotes consistent engagement with financial management practices.

Tip 5: Regularly Review Investment Performance.

Consistent monitoring of investment performance within the application enables timely adjustments to investment strategies based on market conditions and financial goals. Regular reviews optimize portfolio performance and mitigate potential risks.

Tip 6: Leverage Debt Management Tools.

Utilizing debt management tools within the application facilitates the development and implementation of effective debt reduction strategies. Tracking debt balances, interest rates, and payment schedules promotes informed decision-making regarding debt repayment.

Tip 7: Maintain Data Security.

Prioritizing data security through strong passwords, multi-factor authentication, and regular software updates protects sensitive financial information from unauthorized access. Implementing robust security measures safeguards financial well-being.

Consistent application of these tips empowers informed financial decision-making, facilitates efficient financial management, and promotes long-term financial well-being.

The following conclusion summarizes key takeaways regarding leveraging personal finance applications for optimal financial management.

Conclusion

Optimal personal finance management applications empower informed financial decision-making through an array of integrated tools. From budgeting and expense tracking to investment monitoring and debt management, these applications provide a comprehensive platform for achieving financial well-being. Security and user-friendliness are paramount, ensuring responsible data handling and a seamless user experience. Effective utilization requires proactive engagement, including regular account reconciliation, goal setting, and strategic leveraging of automated features. Choosing the right application and utilizing its features strategically is crucial for success.

Financial well-being requires ongoing effort and adaptation. Applications designed for personal finance management offer invaluable support in navigating the complexities of modern financial landscapes. By embracing technology and adopting sound financial practices, individuals can pave the way for a more secure financial future.