Developing a robust financial plan involves understanding income and expenses, allocating resources strategically, and consistently setting aside funds for future goals. This includes tracking spending, identifying areas for reduction, and establishing realistic savings targets. For example, one might analyze monthly credit card statements to pinpoint non-essential expenditures and then redirect those funds toward a high-yield savings account.

Sound financial management provides a foundation for long-term security and opens doors to opportunities. It empowers individuals to navigate unexpected financial challenges, pursue personal aspirations such as homeownership or higher education, and ultimately achieve financial independence. Historically, effective money management has been a cornerstone of individual and societal prosperity, enabling investment, innovation, and economic growth.

The following sections will delve into the core components of successful financial planning, exploring practical strategies for creating a sustainable budget, identifying avenues for saving, and making informed decisions about resource allocation.

1. Track Spending

Tracking spending forms the foundational bedrock of effective budgeting and saving. Without a clear understanding of where money goes, creating a realistic budget or identifying areas for potential savings becomes an exercise in guesswork. This critical first step provides the necessary data to understand financial habits, revealing patterns of expenditure that might otherwise remain hidden. For example, individuals might be surprised to discover how small, recurring expenses, like daily coffee purchases, accumulate over time. Quantifying these expenditures allows for informed decisions about resource allocation.

Several methods facilitate spending tracking. Traditional methods, such as maintaining a detailed spending journal or using spreadsheet software, offer granular control. Numerous personal finance applications provide automated tracking features, often categorizing expenses and offering visual representations of spending habits. Regardless of the method chosen, consistency is paramount. Accurate data, gathered over a representative timeframe, offers the clearest picture of financial behavior. This data-driven approach empowers individuals to make informed decisions about their finances, transforming abstract goals into concrete action plans.

Gaining control of personal finances requires an honest assessment of spending habits. Tracking spending provides the necessary insights to create a realistic budget, identify areas for savings, and ultimately achieve financial goals. While initial efforts may require dedicated focus, the long-term benefits of financial awareness significantly outweigh the short-term investment of time and effort. This crucial step lays the groundwork for informed financial decision-making, paving the way for financial security and future opportunities.

2. Create a budget.

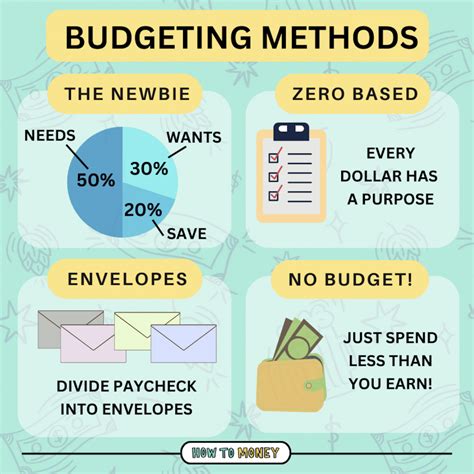

Budget creation represents a cornerstone of effective financial management. A well-structured budget functions as a financial roadmap, guiding resource allocation and facilitating progress toward financial goals. It provides a framework for aligning spending with income, enabling individuals to prioritize essential expenses, reduce unnecessary expenditures, and allocate funds for saving and investment. Without a budget, financial decisions often become reactive rather than proactive, increasing the risk of overspending and hindering progress toward long-term objectives. For instance, a household operating without a budget might find itself consistently short of funds for planned expenses, relying on credit card debt, while a household with a defined budget can proactively allocate resources and avoid such pitfalls.

Effective budgets incorporate both short-term and long-term financial goals. Short-term goals, such as reducing debt or accumulating an emergency fund, require specific allocation of resources within the budget framework. Long-term goals, such as retirement planning or purchasing a home, necessitate a broader, more strategic approach. A budget provides the structure for balancing these competing demands, ensuring that short-term needs are met while simultaneously working toward long-term aspirations. For example, a family saving for a down payment on a house might allocate a specific percentage of their monthly income towards this goal within their budget, while also ensuring sufficient funds for daily living expenses and debt reduction.

Budget adherence requires discipline and periodic review. Unforeseen circumstances and evolving financial priorities necessitate flexibility and adaptation. Regular review of the budget allows for adjustments based on changing needs and progress toward established goals. This dynamic approach ensures that the budget remains a relevant and effective tool for financial management. Successfully navigating the complexities of personal finance hinges on the ability to create and maintain a well-structured budget, providing the framework for achieving financial security and long-term prosperity.

3. Set clear goals.

Goal setting provides crucial direction and motivation within the framework of effective budgeting and saving. Without clearly defined objectives, financial efforts lack focus, hindering progress and diminishing motivation. Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals transforms abstract aspirations into concrete targets. This specificity allows for the development of targeted strategies and provides a benchmark against which to measure progress. For example, rather than simply aiming to “save more,” a SMART goal might be to “accumulate $10,000 in an emergency fund within 12 months.” This clearly defined objective informs budget allocation decisions and provides a tangible measure of success.

The connection between goal setting and financial success extends beyond mere motivation. Clearly defined goals inform budget priorities and spending decisions. When a specific objective, such as purchasing a home or funding a child’s education, is established, it becomes easier to identify and eliminate non-essential expenditures. Knowing that every dollar saved contributes to a larger purpose strengthens resolve and fosters financial discipline. This purposeful approach to financial management ensures that resources are allocated effectively and progress toward desired outcomes is maximized. For instance, a family saving for a down payment on a home might prioritize reducing discretionary spending on entertainment or dining out, knowing that those funds are directly contributing to their goal.

Goal setting provides the compass and motivation necessary for successful financial management. Clearly defined objectives transform the budgeting and saving process from a mundane task into a purposeful pursuit. By aligning financial decisions with clearly articulated goals, individuals gain a sense of control and purpose, enhancing their ability to achieve long-term financial security and realize their aspirations. Challenges such as unexpected expenses or market fluctuations can be navigated more effectively when grounded in the context of established goals, underscoring the importance of this crucial component within the broader framework of financial planning.

4. Automate Savings.

Automating savings represents a cornerstone of effective financial management, streamlining the process of accumulating funds and fostering consistent progress toward financial goals. By removing the element of manual intervention, automated systems ensure regular contributions to savings and investment accounts, regardless of fluctuating motivation or competing demands. This systematic approach fosters financial discipline, promotes long-term growth, and minimizes the risk of impulsive spending depleting allocated savings. Integrating automated savings mechanisms within a broader financial plan significantly enhances the probability of achieving financial objectives.

- Scheduled Transfers:Regular, automated transfers from a checking account to a designated savings or investment account form the foundation of automated savings. These pre-authorized transfers, scheduled to align with paydays or other regular intervals, ensure consistent contributions regardless of daily financial decisions. For instance, an individual might schedule a bi-weekly transfer of $200 from their checking account to a high-yield savings account. Over time, these consistent contributions accumulate significantly, fostering substantial progress toward financial goals.

- Payroll Deductions:Many employers offer payroll deduction programs that facilitate automated savings directly from an individual’s paycheck. This method streamlines the savings process by diverting funds before they reach the checking account, minimizing the temptation to spend. Contributions can be directed to various retirement savings plans, such as 401(k)s or Roth IRAs, or allocated to other designated accounts. Payroll deductions represent a convenient and effective method for accumulating retirement savings and achieving other long-term financial objectives.

- “Round-Up” Savings Apps:Several financial technology applications offer “round-up” savings features, automatically rounding up every purchase to the nearest dollar and transferring the difference to a linked savings account. While seemingly small, these micro-savings accumulate over time, contributing meaningfully to savings goals without requiring significant lifestyle changes. This passive saving approach can introduce individuals to the benefits of automated savings and encourage more structured financial planning. For example, a $4.50 coffee purchase would result in a $0.50 transfer to the linked savings account.

- Investment Platform Automation:Many investment platforms offer automated features such as recurring investments or dividend reinvestment plans (DRIPs). Recurring investments automatically purchase a specified amount of a chosen investment at regular intervals, facilitating consistent portfolio growth. DRIPs automatically reinvest dividends earned back into the underlying investment, compounding returns over time. These automated tools simplify investment management and promote long-term wealth accumulation.

The consistent and disciplined approach facilitated by automated savings mechanisms significantly contributes to long-term financial success. By integrating these tools into a comprehensive financial plan, individuals establish a foundation for achieving financial security and realizing their financial aspirations. The cumulative effect of regular, automated contributions, combined with the power of compound interest, generates substantial long-term growth, highlighting the importance of automated savings within the broader context of effective financial management. This proactive strategy allows individuals to build wealth steadily, effectively navigating the complexities of personal finance and securing their financial future.

5. Reduce unnecessary expenses.

Reducing unnecessary expenses forms an integral component of effective budgeting and saving strategies. Careful evaluation of spending habits often reveals expenditures that, while individually small, collectively contribute significantly to financial outflow. Eliminating or reducing these non-essential expenses frees up resources for allocation towards savings goals, debt reduction, or investment opportunities. This principle operates on the understanding that small, consistent savings accumulate over time, generating substantial long-term financial benefits. For example, consistently preparing meals at home rather than dining out, or canceling unused subscription services, can generate significant savings over the course of a year. These reclaimed funds can then be redirected towards higher-priority financial objectives, accelerating progress and reinforcing positive financial habits.

Practical application of this principle requires a thorough analysis of current spending patterns. Reviewing bank statements, credit card bills, and budgeting apps provides a detailed overview of where money is being spent. Categorizing expenses allows for identification of areas where reductions can be implemented without significantly impacting lifestyle or essential needs. Distinguishing between “needs” and “wants” becomes crucial in this process. While basic necessities like housing, food, and transportation are non-negotiable, discretionary spending on entertainment, dining, or luxury items often presents opportunities for reduction. For instance, opting for less expensive entertainment options, such as free community events or streaming services instead of premium cable packages, can generate substantial savings without requiring drastic lifestyle changes. This conscious and strategic approach to spending empowers individuals to gain control of their finances and make informed decisions that align with their broader financial goals.

Successful implementation of a cost-reduction strategy requires ongoing monitoring and adjustment. Financial priorities and circumstances evolve over time, necessitating periodic review of spending habits and budgetary allocations. Unexpected expenses or changes in income may require adjustments to spending patterns to maintain financial stability. Regularly evaluating expenses and refining budgeting strategies ensures that financial plans remain relevant and effective. The ability to identify and eliminate unnecessary expenses represents a crucial skill within the broader context of effective financial management, paving the way for long-term financial security and the achievement of financial aspirations.

6. Explore investment options.

Exploring investment options represents a crucial step beyond budgeting and saving, transitioning from preserving capital to growing it. Effective budgeting creates a surplus of funds available for investment, enabling individuals to pursue long-term financial goals such as retirement planning, wealth accumulation, or funding significant life events. This transition marks a shift from a defensive financial posture focused on stability to a more proactive approach aimed at maximizing returns. The act of investing strategically utilizes accumulated savings as a tool for generating future income and building long-term wealth. For instance, a consistent monthly surplus achieved through budgeting can be directed towards investments in diversified stock portfolios, real estate, or other asset classes with the potential for long-term growth.

Understanding the relationship between risk and return becomes paramount when exploring investment options. Higher potential returns typically correlate with increased risk, requiring careful consideration of individual risk tolerance and financial objectives. Diversification across different asset classes mitigates risk by spreading investments across various sectors and investment vehicles. This balanced approach minimizes the impact of potential losses in any single area. For example, allocating a portion of savings to lower-risk bonds alongside higher-risk stocks balances potential volatility with more stable returns. Professional financial advisors can provide tailored guidance based on individual circumstances, helping navigate the complexities of the investment landscape and make informed decisions aligned with specific financial goals. Their expertise offers valuable insights into market trends, investment strategies, and risk management techniques.

Strategic investment serves as a catalyst for long-term financial growth, leveraging the foundation established through effective budgeting and saving. While inherent risks exist in any investment, informed decision-making, diversification, and professional guidance mitigate these risks and maximize the potential for returns. This proactive approach transforms accumulated savings into a dynamic engine for wealth creation, accelerating progress toward financial independence and securing long-term financial well-being. The integration of investment strategies within a comprehensive financial plan solidifies the connection between disciplined budgeting, consistent saving, and the pursuit of long-term financial prosperity. It represents the culmination of effective financial management, transitioning from financial stability to financial growth and empowerment.

Frequently Asked Questions

Addressing common queries regarding financial planning provides clarity and facilitates informed decision-making. The following questions and answers offer insights into practical strategies and address potential concerns.

Question 1: What is the most effective method for tracking expenses?

Numerous methods exist, ranging from traditional spreadsheet software to dedicated budgeting applications. The optimal choice depends on individual preferences and technological proficiency. Consistency, regardless of the chosen method, remains paramount.

Question 2: How frequently should a budget be reviewed?

Regular review, ideally monthly, allows for adjustments based on evolving financial circumstances and progress toward established goals. Life changes, unexpected expenses, and shifts in income necessitate periodic reassessment.

Question 3: What constitutes a reasonable emergency fund?

Financial advisors typically recommend accumulating three to six months’ worth of essential living expenses in a readily accessible account. This reserve provides a financial buffer against unforeseen circumstances such as job loss or unexpected medical expenses.

Question 4: How can individuals overcome emotional spending habits?

Emotional spending often stems from underlying psychological factors. Identifying triggers and developing coping mechanisms, such as mindful spending practices or seeking professional guidance, can help mitigate impulsive purchases.

Question 5: What is the optimal allocation between saving and investing?

The ideal balance depends on individual financial goals, risk tolerance, and time horizon. Generally, short-term goals necessitate a higher emphasis on saving, while long-term objectives benefit from a greater allocation towards investments.

Question 6: When should professional financial advice be sought?

Complex financial situations, significant life changes, or uncertainty regarding investment strategies often warrant professional guidance. Financial advisors provide tailored expertise and objective perspectives, facilitating informed decision-making.

Developing a robust financial plan requires ongoing learning, adaptation, and consistent effort. Addressing common concerns through informed inquiry empowers individuals to navigate the complexities of personal finance and achieve long-term financial well-being.

Further resources and tools for enhancing financial literacy and developing personalized strategies can be found in the following sections.

Practical Tips for Effective Financial Management

Implementing practical strategies facilitates consistent progress toward financial goals. The following tips provide actionable guidance for optimizing budgeting and saving practices.

Tip 1: Visualize Financial Goals.

Creating a visual representation of financial aspirations, such as a vision board or a savings goal tracker, enhances motivation and reinforces commitment. Visual reminders maintain focus and encourage consistent effort.

Tip 2: Embrace the Power of Small Savings.

Consistently reducing small, recurring expenses, like daily coffee purchases or impulse buys, generates substantial cumulative savings over time. Redirecting these funds towards savings or investment accounts accelerates progress toward financial goals.

Tip 3: Negotiate Recurring Bills.

Regularly negotiating with service providers, such as insurance companies or utility companies, can lead to reduced rates or better terms. Proactive negotiation minimizes recurring expenses and frees up resources for other financial priorities.

Tip 4: Prioritize Debt Reduction.

Allocating surplus funds towards high-interest debt accelerates financial progress. Reducing debt minimizes interest payments and frees up resources for saving and investment.

Tip 5: Utilize Budgeting Apps and Tools.

Numerous budgeting applications and online tools facilitate expense tracking, budget creation, and financial goal setting. Leveraging these technologies simplifies financial management and enhances efficiency.

Tip 6: Seek Financial Education.

Continuously expanding financial knowledge through books, workshops, or online resources empowers informed decision-making. Enhanced financial literacy strengthens the foundation for effective budgeting and saving practices.

Tip 7: Review and Adapt Regularly.

Financial circumstances and goals evolve. Periodically reviewing and adjusting budgeting and saving strategies ensures continued relevance and effectiveness. Adaptability maintains alignment between financial plans and current realities.

Consistent application of these practical tips strengthens financial discipline, optimizes resource allocation, and accelerates progress toward financial objectives. Integrating these strategies within a comprehensive financial plan fosters long-term financial well-being and empowers informed financial decision-making.

The following conclusion summarizes the key principles and benefits of effective financial management.

Conclusion

Effective budgeting and saving practices constitute the cornerstone of sound financial management. Disciplined resource allocation, informed spending decisions, and consistent saving habits empower individuals to achieve financial security and pursue long-term goals. From tracking expenditures to exploring investment opportunities, each component contributes to a comprehensive strategy for maximizing financial resources and building a secure financial future. The cumulative impact of these practices extends beyond immediate financial stability, fostering opportunities for personal and professional growth, reducing financial stress, and enabling informed decision-making across all aspects of life.

Financial well-being represents an ongoing journey, requiring continuous learning, adaptation, and commitment. Embracing the principles of effective financial management empowers individuals to navigate the complexities of the financial landscape and build a foundation for lasting prosperity. The pursuit of financial security represents an investment in one’s future, unlocking potential and paving the way for a life of financial freedom and opportunity.